Sony Ericsson has just posted their 2011 Q3 earnings report with a mixed bag. The joint venture between Sony and Ericsson has had a rough time in the past few years against the onslaught of the iPhone and bitter rivalry in the Android community which had current CEO, Bert Nordberg reflect on the last few years. With profits dropping though, this could potentially play favorable for Sony who is looking to buy the remaining shares of Ericsson and bring the entire mobile operation in house.

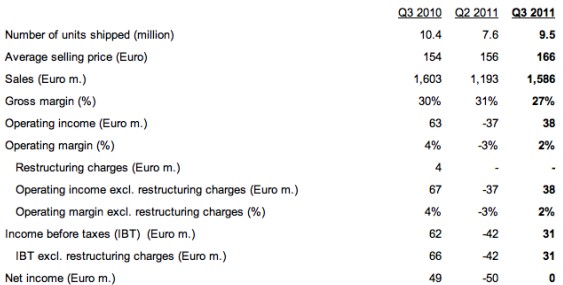

Though profits have dropped, the company was actually able to break even for the quarter, versus the previous year which saw the company bleed out €50 million. This was mostly due to higher taxes, €17 million versus last years €12 million. Net profits were also down to zero, compared to last years €49 million ($67.26 million) during Q3 but better that Q2 of 2011 €50 million loss ($69 million).

Sales were also down for the year, to €1.59 billion ($2.18 billion) from €1.6 billion ($2.2 billion) last year. However, some things are starting to go right for the company which was able to shift 80% of its business to Xperia smartphones with 22 million units shipped. The company was also able to raise the average selling price of each phone to €166 ($230) versus €154 ($213) for Q3 2010 which should help the company reach a profitability faster. Units shipped were also down 9.5 million verse the high of 10.4 million for Q3 2010 but much improved when compared to 7.6 million for Q2 2011. Sony Ericsson CEO, Bert Nordberg had this to say;

“We will continue to invest in the smartphone market, shifting the entire portfolio to smartphones during 2012.”

After the jump, full PR and your chance to comment awaits you.

Sony Ericsson reports third quarter 2011 results

Highlights:

Income before taxes was Euro 31 million

33 percent increase in sales quarter-on-quarter

Smartphones account for more than 80 percent of total salesBert Nordberg, President and CEO of Sony Ericsson commented, “We delivered a solid 73 million Euro improvement in income before taxes as we rebounded from the previous quarter with a 33 percent increase in sales. Android-based Xperia(TM) smartphone sales now account for more than 80 percent of sales and we have shipped 22 million Xperia smartphones to date. We will continue to invest in the smartphone market, shifting the entire portfolio to smartphones during 2012.”

Units shipped during the quarter were 9.5 million, a 9% decrease year-on-year due to a decline in feature phone shipments, partially offset by an increase in smartphone shipments. The 25% quarter-on-quarter increase was due to the higher volume of smartphones shipped.

Average selling price (ASP) for the quarter was Euro 166, up 8% year-on-year and 6% sequentially. The year-on-year increase was due to the shift to smartphones and geographic mix despite a negative effect from foreign exchange rates. The sequential increase was due to product and geographic mix.

Sales for the quarter were approximately Euro 1.6 billion and essentially flat year-on-year.

The gross margin percentage for the quarter was 27%, a decrease of 3 percentage points year-on-year and 4 percentage points from the previous quarter. The year-on-year decrease in margin is attributed to product and geographic mix. The sequential decrease in margin was due to inventory-related adjustments and product and geographic mix.

Income before taxes for the quarter was Euro 31 million, compared to income before taxes of Euro 62 million for the same quarter in the previous year. Loss before taxes for the previous quarter was Euro 42 million. The sequential improvement was reflective of higher sales and lower operating expenses, while the year-on-year decline was due to lower gross margin percentage offset by lower operating expenses.

Net income during the quarter improved by Euro 50 million sequentially, while net income decreased by Euro 49 million year-on-year. Income taxes recorded during the quarter reflect the distribution of profits and losses between various jurisdictions and tax adjustments. Minority interest reflects higher net income at a majority-owned joint venture company.

Cash flow from operating activities during the quarter was Euro 53 million. External borrowings of Euro 51 million were repaid during the quarter, resulting in total borrowings of Euro 718 million at the end of the quarter. Total cash balances at September 30, 2011 amounted to Euro 466 million.

Sony Ericsson estimates that its share of the global Android-based smartphone market during the quarter was approximately 12% in volume and 11% in value.

Sony Ericsson maintains its forecast for modest industry growth in total units in the global handset market for 2011.

You must be logged in to post a comment.