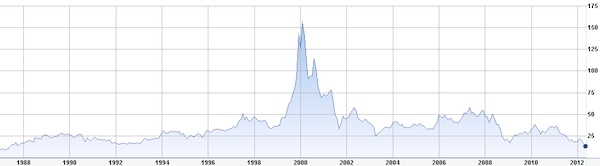

With the Euro debt crises continuing to rage on as Greece throws new curve balls to the market, many investors and companies have toned down their expectations of a short recovery in the European market. With consumer confidence down, many European companies have taken a beating in their stock prices while companies with a heavy presence have also seen their stock prices decline. With Europe representing Sony’s last strong territory where many there still see Sony as a contender and strong brand in the face of Apple and Samsung, Sony has seen a rapid selloff of their stocks in the past month. After hitting a 10 year low just last week, the companies stock price now sits at $14.94, a new 25 year low for the Japanese electronic giant.

Keita Wakabayashi, an analyst at Mito Securities Co. said:

“The French election is causing concerns that a weaker euro will bring negative impacts to exporters and uncertainties over Europe’s economy going forward,”

He went on to say:

“Sony’s impact from the euro’s decline is fairly large compared to others.”

For Sony, Europe represents 21 percent of its annual revenue. With the highly lucrative mobile races well into their 5th year, Sony holds next to no market share in the US and relies heavily on sales of their Xperia line of Android smartphones in Europe. With a battered down TV business, Sony’s new President and CEO, Kaz Hirai is betting on his ‘One Sony‘ initiative to save the company.

Discuss:

What do you think Sony needs to do to turn around their fortunes?

You must be logged in to post a comment.