Many of us here at SonyRumors have been watching Sony’s mobile strategy carefully and wondering what their next plans are, particularly, regarding the US. With the stellar success of the Xperia Z – a phone which ranks in the top three smartphones in over 20 markets by revenue, followed by the mammoth Xperia Z1 it has been an antagonizing wait for US consumers to see when the next hot Sony smartphone will come to US shores, or worse – if at all.

The company has just released it’s second fiscal results which tells us a lot more about what’s going on at the company and we can’t forget CEO Kaz Hirai’s unpopular announcement that the US was not a priority market at the moment and hinting at a reduced presence in the market. With a combination of CEO comments and fresh fiscal results we can start to see exactly why Sony is bailing the US and perhaps estimate when they might return. After the jump, the Q2 FY13 Sony financial results.The first number that comes to mind is 40. That’s the percentage of the increase in sales of smartphones that the company has enjoyed compared to the same period this time last year. (39.3% to be exact). As my colleague pointed out, the company has been targeting Europe and Asia, releasing a steady flow of smartphones to the markets. So Sony estimates it’s EurAsian mobile strength as a reason to focus there and that US is not as profitable enough to stay it’s current capacity.

No smartphone manufacturer with global ambitions can ignore the US market. But it takes a substantial amount of resources to engage fully such a giant market. The fact is, Sony has problems with supporting a US embrace because of financial drains elsewhere in the company, but more on that later. In addition to this, competitively, this is Apple’s home-ground. No company bursts into a market with a delicate balance sheet and attacks the chief competitor on it’s home turf. HTC’s demise is a reminder that a hot-looking phone that does everything you want doesn’t guarantee the company’s survival.

So exactly what is their mobile strategy?

Expansion vs Concentration

In it’s second quarter fiscal results for this year, Sony referenced it’s strategy in the electronics division, which includes mobile:

In electronics, Sony has been engaged in developing competitive products and creating new markets through the concentration of management resources in its three core business areas and has reinforced its business foundation through an overhaul of its cost structure.

The two key words here in this context are concentration and reinforced. Little guessing is needed, they are telling us what they’re doing. They are using success in Europe and Asia to back-up their position in those markets. If they simply diverted profit from these markets to a US market assault, they would be leaving their EurAsian markets unprotected. The smartphone era has already established the point that unattended markets will be conquered, bye-bye Nokia. Raise your hand if you own a Nokia? (tumbleweed blows). Sony is feeding it’s EurAsian markets with it’s establishing profit and presence.

It would be characteristic of a company with a much broader and considerably deeper balance sheet to spring into a huge market with determination. Sony’s existing US presence is likely only tolerable – the existing presence in the US market must be close to the profit point (on either side) if Sony is talking about reducing presence or leaving. It just doesn’t have the deep pockets to take on Apple, yet.

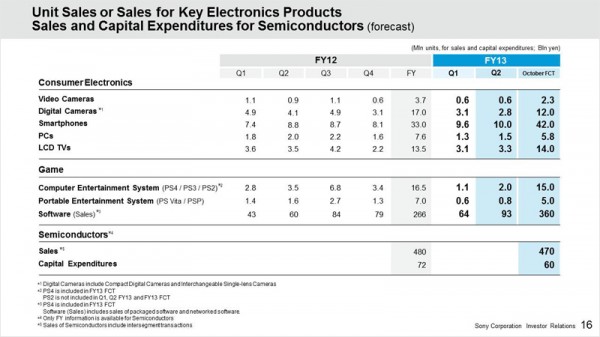

Here is a view of smartphone sales growth per quarter in 2012 and well as 2013 progress. It should be noted that Sony did not experience a significant boost in sales in the Q3 or Q4 in 2012 and unless it does so in the following two quarters of FY13, it could possibly miss it’s yearly target of 42m sales. That is not a prediction that it won’t, rather that it’s 9.6+10m sales this year won’t reach 42m without a boost on current sales. More high-profile launches could do this, and Sony doesn’t fail in that area.

What Else is Going on at Sony Corp?

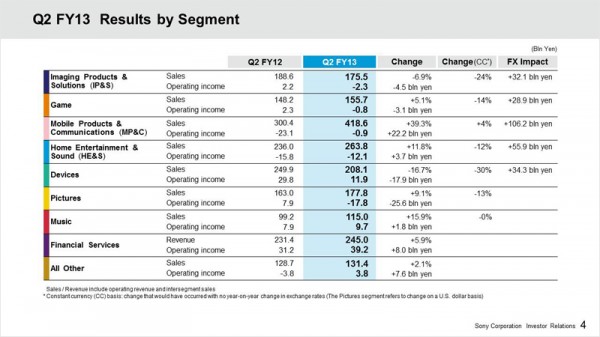

If Sony Mobile plans are inhibited by broader financial issues, it’s time to find the balloon-burster. The second quarter fiscal results can be described as a tumble, a fall. After a better-than-expected march into the fiscal year 2013 with rising smartphone sales and a seemingly belated stabilization in the TV division, the markets reacted with confidence as shares sailed high all year. We cannot forget the imminent PS4 launch. Such a high-profile launch that is also launching at the same time as the chief competitor demands considerable attention and resources. But seemingly even the mighty PS4 launch isn’t the drain on finances and Sony has again reminded that it will not be a profit problem upon launch. Let’s take a closer look:

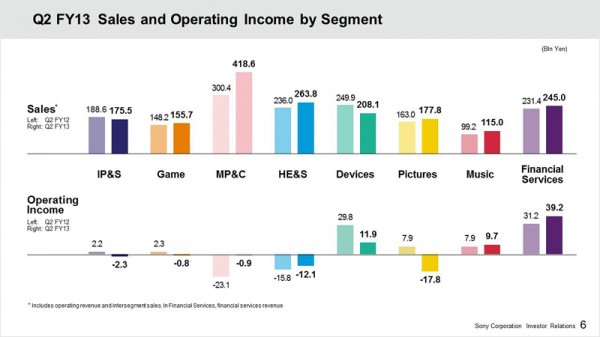

If you prefer to read a bar chart:

Poorly performing segments: the Devices segment has suffered a tumble in profitability, even if sales are reasonably strong (though again, falling) and Sony Pictures failed to deliver a strong set of figures based on the same period in 2012 (a disappointment for CEO Kaz Hirai in his rebuff to investor calls for a stake sale). Commenting on this segment, Sony didn’t answer much about why this segment failed to perform. It simply referenced good performance in some areas and poor performance in others. But we know it’s a problem from these figures. Other segments reported far smaller changes in year-on-year performance, yet still in the negative: Imaging Products & Solutions and Game. Game will explode in the next quarter, and Sony’s projections confirm this.

Other small changes, though interesting to note include a modest increase in profits from the Music division – always noteworthy for any company that isn’t Apple. Sony cited Justin Timberlake as a key performer. The star player Financial Services continues to grow, supporting the other weaker segments. Mobile has made a jump in profits based on the same period in 2012. This is good, but clearly not enough if Sony has made a net loss in Q2.

The Bottom Line

Sony is telling us that it is concentrating it’s efforts in the mobile division in markets where it is currently succeeding the most. Bigger challenges like the US market will likely be undertaken when the overall company is in a better financial position to do so. (That part is speculation, though it ties in with Sony’s ambition to become the global #3 player in mobile). It just doesn’t have the deep pockets it would need to take over the world immediately. Rest assured, if mobile growth continues as is, then it will come back to the US. It’s difficult to not notice that competitor Apple has had better days – missing profit forecasts and an obvious drop in innovation with the loss of it’s Innovation King. The broader performance of Sony Corp. is directly related to it’s ability to launch grand plans and it has stumbled in Q2 after an auspicious Q1. The next fiscal quarter will include the arrival of the PS4 but the recent 10% drop in share price after a difficult Q2 tells us the market does not ignore poorly performing sectors and Sony would do well to maintain profitability in these other segments to build on momentum.

(Via Sony)

Discuss:

Is Sony planning it’s mobile strategy competitively? Is there time to delay a full US market focus? Will they reach their 42m smartphone sales target this year?

You must be logged in to post a comment.