If you’re a tech company, the last space you likely want to enter – if you haven’t already – is the hyper-competitive smartphone market, and if you’re already there, chances are that you’re hurting. Bad. That’s because, short of Apple and (kind of) Samsung, nobody is making money. Look no further than Sony’s 2015 mobile efforts – where all we read about is how low sales volume are compared to rivals Samsung, HTC, and LG, let alone Apple – so surely Sony needs to exit mobile, right?

(Please note that you can click on all charts for a higher resolution version)

Wrong. We’ve heard time and time again from Sony CEO Kaz Hirai that their primary focus is on premium devices and not volume – a sentiment that’s very different from most Android makers – and they’re on to something.

In theory, Sony’s strategy makes sense because, the more expensive a handset, the higher the profits on it (usually). If you’re selling a phone for only $200, there isn’t a whole lot of room for profits when you consider R&D, components, marketing, and other factors like licensing. The trouble is, Android makers are now going down the same path PC makers did a decade ago by going to war with a race towards the bottom and in turn, leaving no profits in the market.

This is worrisome for a few reasons. Charles Arthur writes:

That’s a decline of 90m, even while the overall smartphone market has grown from 704m (of which 501m were Android) to 1.43bn (of which 1.16bn were Android).

But your objection is probably the same as mine: isn’t the decrease in those sur-$500 shipments because the price of high-end Android handsets has fallen? The price you have to pay to get something with the same qualities as the $500-or-more Android flagship is lower than it was in 2012.

This is almost certainly true – but it isn’t much compensation for those struggling to expand their sales and seeing average selling prices (ASPs) fall.

That last part is absolutely crucial, and something that many fans miss as all they see is this large pie owned by Android.

if you keep selling the same number of phones at lower ASP, your profit will inevitably fall off a cliff as fixed costs such as staff and administration weigh you down.

As we’ve seen, Sony’s units shipped have been on a steady decline with them barely registering 30 million units sold in 2015. As a comparison, Apple and Samsung do that in a quarter.

Just look at the above chart to see the sales difference between Apple, Samsung, and LG in Q4 2015. Though Sony is only surpassing HTC and Microsoft Mobile in sales, they are far ahead of the game – and even besting LG when it comes to profits despite their 2-1 sales lead. A lot more details and charts after the jump.

Over the weekend, Sony Mobile Canada pulled the much anticipated Android 6.0 Marshmallow update from the Xperia Z5 and Xperia Z5 Premium. Though they’ve yet to issue a reason for pulling the update, a great many have been having minor issues like Bluetooth connectivity woes among other things.

Over the weekend, Sony Mobile Canada pulled the much anticipated Android 6.0 Marshmallow update from the Xperia Z5 and Xperia Z5 Premium. Though they’ve yet to issue a reason for pulling the update, a great many have been having minor issues like Bluetooth connectivity woes among other things.

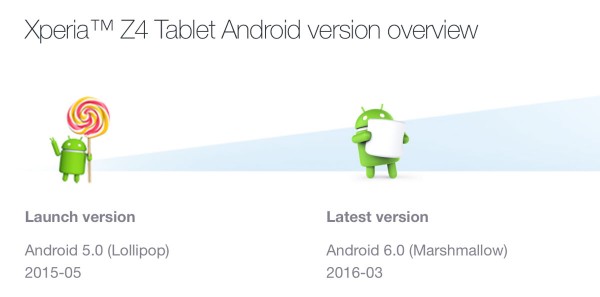

It’s no surprise that Android 6.0 Marshmallow arrived first on

It’s no surprise that Android 6.0 Marshmallow arrived first on

After months of waiting, betas, and teasers,

After months of waiting, betas, and teasers,

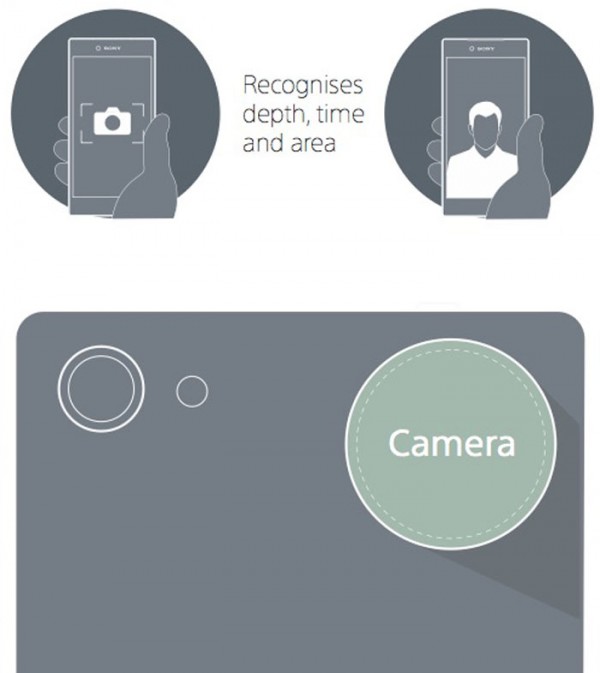

The next generation Xperia camera takes spontaneous capture to another level allowing you to shoot in sharp focus, even for spur-of-the-moment shots.

The next generation Xperia camera takes spontaneous capture to another level allowing you to shoot in sharp focus, even for spur-of-the-moment shots.

You must be logged in to post a comment.